In this section

We back impact-driven companies that are driving meaningful solutions for the urgent ecological and social challenges of our age, since 2009.

With €200M AUM, we specialise in early-stage technology companies in DACH, the UK, Nordics and the Benelux across areas such as biodiversity and climate solutions, health, education, employment, ageing populations, spacetech and sustainable consumption.

Our latest fund of €108M, an Article 9 fund, was backed by the European Investment Fund (EIF) and the German State Development Bank KfW Capital, Investcorp Tages and many European entrepreneurs and families.

Ananda was co-founded in Munich in 2009 by Johannes Weber, a serial entrepreneur and Florian Erber, an entrepreneur and former VC with over twenty years of startup and VC experience. The team now consists of nineteen people that have broad experiences of founding their own businesses.

The Ananda Impact Ventures Partners: Bernd Klosterkemper, Florian Erber, Zoe Peden, Johannes Weber.

Our Investments Strategy

We are impact generalists. We believe the world’s biggest challenges cannot be solved in isolation. That is why we invest in technological solutions with the potential to improve entire industries, regardless of their sector.

So far we have supported 35 companies. Our Social Venture Fund I (recently completed with a 2X money-on-invested-capital) was focused on generating social impact. With Social Venture Fund II (SVF II) we started broadening our areas of impact to include environmental impact. SVF II is on a good track to generate an even higher return. With Ananda Impact Fund III (AIF III) and Ananda Impact Fund IV (AIF IV) we no longer make a clear distinction between social and environmental impact. We take the stance that all sectors are interconnected—educational outcomes impact environmental ones; how you handle biodiversity has a bearing on how much carbon you emit; carbon emissions affect healthcare; health and well-being correlate with education. Impact investing is about creating a portfolio that can cross-pollinate, allowing one company to have knock-on effects on another.

A powerful framework that helped us to reduce our bias and guided us towards what’s really important is the The Planetary Boundary framework that was introduced in a Nature article named “A safe operating space for humanity” in 2009. The framework shows why focusing on climate change and greenhouse gas (GHG) emissions alone is insufficient because the Earth is a complex of interrelated ecosystems. Violating one category can have catastrophic impacts on another.

We have found that pursuing solutions to the world’s—and therefore, humanity’s—most urgent problems has naturally led us to the most ambitious, scalable, and industry-defining companies.

The Nine Planetary Boundaries

For example, the planetary boundary for biodiversity has been significantly overshot. It is predicted that human activity has led to a 83% loss of wild mammal biomass and 50% decline in plant biomass, yet measuring precise losses and assessing the regional and global impacts poses a huge challenge.

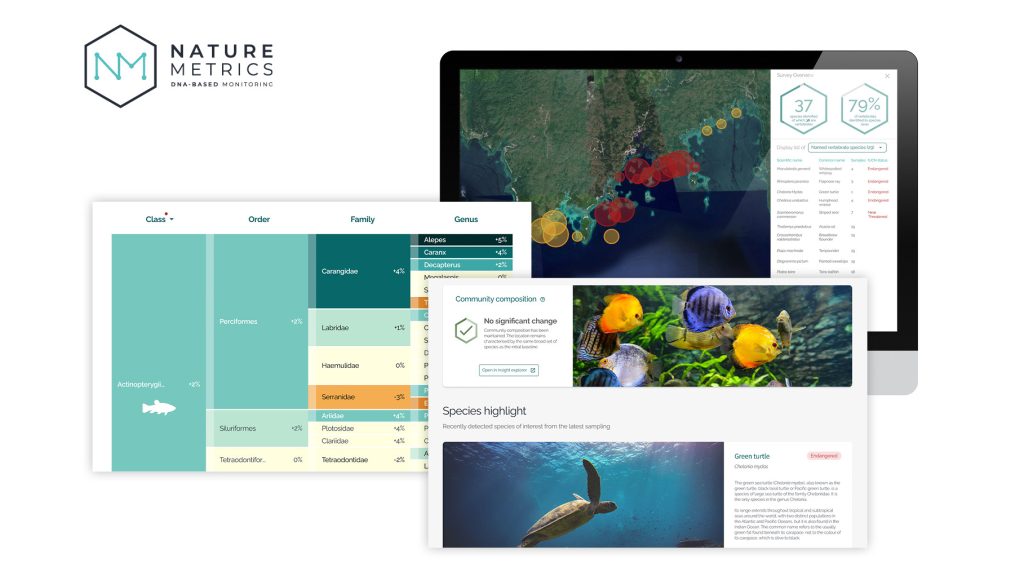

In 2022 we invested in NatureMetrics, a company that monitors biodiversity with eDNA sampling. It was one the very first investments in the new biodiversity megatrend. This year the company was made a semi-finalist of the renowned X Prize.

In 2022 NatureMetrics launched the world-first nature performance monitoring service powered by eDNA technology.

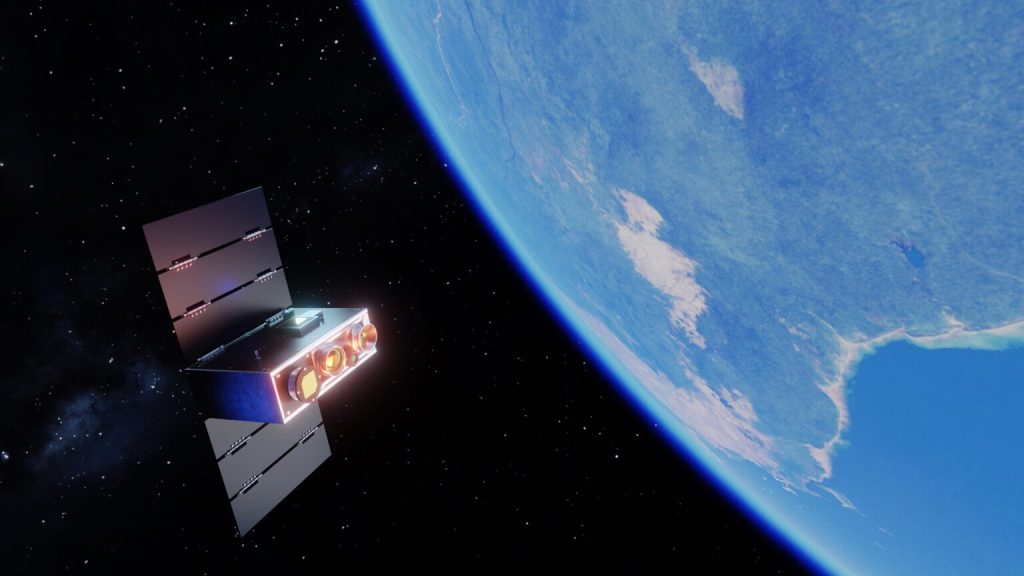

We have also invested in spacetech solutions that can help us to protect our people as well as the planet from space.

OroraTech, one of our Fund III portfolio companies, uses thermal-infrared satellite data to monitor the Earth’s temperature. Their first product, Wildfire Solution, allows to detect, monitor and manage wildfires on a global scale and is trusted worldwide for revolutionising wildfire detection. Managing wildfire has a positive impact in reducing CO2 emissions as well as in preserving the biosphere, protecting freshwater systems, maintaining land systems use, and reducing ocean acidification—which shows just how interlinked the nine planetary boundaries really are. Here is one example, to give a scale to the challenge OroraTech are solving: in 2021, 1.76 billion tonnes of CO2 were emitted from burning forests. If wildfires were a country, it would be the 5th largest emitter globally.

OroraTech has launched a second satellite into space. Their technology has been used to support the management many forest fires including the Fox Lake Wildfire in Alberta, Canada.

Today, our portfolio companies have an impact on 7 out of 9 Planetary Boundaries with the potential to influence their trajectories significantly.

We are constantly looking into what more our investments can do to drive solutions for the world’s biggest challenges, with an open mind and following a holistic and systemic approach.

Our Impact Termsheet

At Ananda, it’s important to us that we are fully aligned with our founders and their mission. To protect their mission and the development of an impactful company we have set new standards with our Impact Termsheet:

1

The Impact Requirement Clause

Impact is at the core of every investment we make. We preserve our portfolio company’s impact mission by linking their business model to the Impact goals.

The Company will be required to stay within their mission statement. KPIs will need to be set to measure the company’s impact.

Ananda will have the right to sell its shares in case of significant deviation from the Company’s societal mission, subject to right of first refusal by existing shareholders.

Extract from Ananda’s Impact Termsheet

We go the extra mile and link our carried interest not only to financial goals, but also to quantifiable impact achievements of the companies we work with. This model, which we co-developed in 2014 with the European Investment Fund, is called “The Impact Carry Model” and has now been adopted by over 80 other funds globally, ensuring that the financial incentives of hundreds of VCs directly align with impact-related priorities.

We only begin to see our carry if at least 60% of the impact target values across our portfolio are reached. Above 60% the carry scales in line with the percentage of the target values reached. Above 80%, we potentially see 100% of the carry, but only if the financial return is also right.

2

Diversity and inclusion clause

Our portfolio companies are encouraged to become category leaders in team diversity.

The Company strives to create and maintain a diverse team, especially at leadership level. One that’s inclusive across gender, ethnicity, age, sexual orientation, disabilities, socio-economic background, and national origins.

Implementation and progress of diversity and inclusion shall be discussed on a regular basis with the Investor.

Extract from Ananda’s Impact Termsheet

At Ananda we have always believed that true creativity and resilience stems from diversity, and we are proud to have received the highest standard accreditation from Diversity VC in 2022 thanks to 45% of our founding teams being diverse in gender, ethnicity and disability.

diverse founding teams in our portfolio (gender, ethnicity, disability)

diversity within the Ananda team (gender, ethnicity, disability)

3

The Founders Health Clause

At Ananda, we consider Founders Health a priority. Since 2020 we have been encouraging our founders to look after themselves and their team also in our Termsheet.

The Founders’ physical and mental health is vital for the success of the Company. Founders work in a highly dynamic environment, and it is part of building a company that things can go wrong, and founders can struggle. The Investors are aware of this and want to support founders as well as they can. The topic of Founder Health shall be discussed on a regular basis on Board level.

Founders are encouraged to use offers like peer-group support, leadership/team coaching, development programs, etc. They are strongly encouraged to work with an external independent coach, both individually as well as with the Founder / C-level team; this coach should be a go-to person not only to discuss business matters, but more importantly in case of personal issues.

Founders are requested to make use of this support at the cost of the company and at any time, especially also in tough times.

Extract from Ananda’s Impact Termsheet

We have also run a series of workshops internally and for our portfolio founders to improve their health and wellbeing. We have also signed the Founder Mental Health Pledge and are constantly improving our Founders Health programme.

The Ananda Founder’s Resilience workshop in October 2022. We hiked up one of our favourite mountains in the Bavarian Alps. Once we reached the top, Palma Michel, our coach and mentor, ran a resilience workshop.

4

Environmental clause

Our portfolio companies are committed to reducing their environmental footprint by acting responsibly.

After closing, the management commits to:

1. Adopting a climate policy as soon as feasible but no later than within 12 months, as defined by measuring the company’s direct operational carbon footprint and setting clear action steps to reduce it.

[…]

Such policy and measures will be reviewed regularly and updated through the Company’s management and the Board.

Extract from Ananda’s Impact Termsheet

Since becoming Article 9, we have strengthened and formalised our approach to measuring impact and have launched a project to streamline our ESG data collection and reporting. We have also gone a step further and added some selected KPIs which we deem as especially relevant for early stage start ups to understand and measure their impact.

Our co-investors include

Our commitments

Bernd Klosterkemper

Partner

Ananda Impact Ventures

Read more on MediumThe interaction with our founders is an area that we need to work on every day; and there is certainly room for improvement — for me, us as investors at Ananda, and our entire industry.”

Let’s talk about you—not your company. How are you? — The Ananda Founders’ Health Programme