At Ananda we believe investing in impactful businesses can lead to a brighter future for all.

13 years ago, we set out to create an impact investing fund at a time when there were very few examples of companies solving social or environmental issues and succeeding financially. Against all odds, we have proven that it is possible to change the world through the power of venture capital.

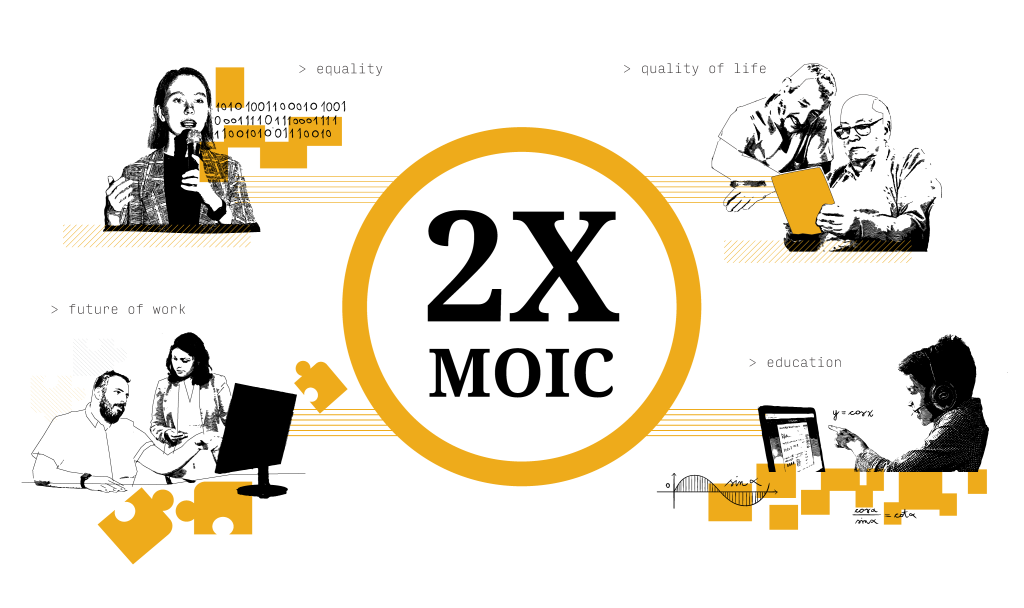

In June 2023 our first fund, the Social Venture Fund I (SVF I) which launched in 2010, has delivered double the money-on-invested-capital (MOIC).

Our first fund has delivered double the money-on-invested-capital!”

SVF I provided crucial backing for startups tackling some of the world’s most critical issues—including education, employment, gender equality, and reducing poverty. 80% of Ananda’s investments gained positive financial and impact returns with the remaining 20% still creating significant impact. In doing so, we have become the first European impact VC firm to prove that impact investing delivers both strong financial returns and positive, measurable impact.

Cyril Gouiffès, Head of Social Impact Investments at the European Investment Fund (EIF), says:

“We are delighted to see the success of SVF I, which was one of the very first investment vehicles dedicated to impact investing in Europe. SVF I has had a tremendous responsibility in putting in motion an impact investment strategy, sourcing cutting-edge impact companies and eventually proving that financial value creation and positive impact can go hand in hand.

It is a critical milestone for the whole industry. We are proud to have supported Ananda from its early days and will continue to support the European impact investing market infrastructure to evidence that financial value, social innovation and sustainable development can be positively correlated”

It is a critical milestone for the whole industry.”

The Ananda Impact Ventures Team

By changing the rules of the game, we have been able to be authentic backers to 35 impact businesses, each of which is committed to creating something truly extraordinary. Together we are building a healthier planet and better life on earth for all.

The Ananda Portfolio By Capital Invested

Last year the world changed. Russian aggression continues to have disastrous consequences for the people of Ukraine, the economy and nature. In today’s challenging environment, our portfolio has proven to be robust, and we are confidently navigating through turbulent waters. The crisis in Ukraine has inspired us to double our efforts in supporting our portfolio companies and founders.

Since inception of the Ananda Impact Fund IV, a 108 Million Euro Article 9 fund, we have made six new investments in game-changing companies tackling biodiversity, waste management, precision medicine, entrepreneurial education and more. We have also invested 17 Million Euro in 13 of our existing portfolio companies across all our funds.

6

new

investments

13

follow-on

investments

The impact sector gives us a lot of reasons to see the future in a positive light. There has been a huge influx of entrepreneurial talent into the impact space, creating some truly outstanding companies.

The introduction of the EU’s Sustainable Finance Disclosure Regulation (SFDR), and the subsequent increase in funds classified as either Article 8 or Article 9, will bring more transparency into the impact sector and contribute to the creation of an impact-driven ecosystem for startups and VCs.

Our 4th impact fund of 108 Million Euro is

SFDR Article 9

This report highlights how we are contributing in solving the world’s biggest challenges at scale, and how we ensure that impact is embedded in the business models of all the companies we invest in.

We invite feedback on this report and our work in general. Our ultimate goal is to keep pushing for transparency and a striving impact sector.

Sincerely,

The Ananda Impact Ventures team

Florian Erber

Managing Partner & Founder

Ananda Impact Ventures

Read more on RealDealsOur next mission, fuelled by our latest €108M fund, is to scale the effectiveness of impact investing and build more businesses that solve some of the most pressing issues facing humanity.”

Fund in Focus: Ananda Impact Ventures realises first ever VC impact fund